You have a lot of interesting trading strategies. You want to combine and apply these at the same time. Have you ever tried to combine different methods of trading? Is this allowed in the trading market and how to combine them most effectively? “Hybrid Trading” that I am about to introduce to you will help you answer that question. Let’s go!

What Is Hybrid Trading?

Hybrid trading and investing is a flexible approach that combines a variety of methods to find profitable opportunities in the market. Rather than relying on just one method, hybrid investors will utilize both fundamental analysis (evaluating a company’s business situation) and technical analysis (evaluating price charts and technical indicators) to make investment decisions.

See now:

- What is Manual Trading? Characteristics of Manual Traders

- 5 Techniques Enter Orders Easily with Position Trading

- 4 Methods to Use Swing Trading Effectively in Forex 2024

- What is Day Trading? How to use Day Trading effectively

Advantages of Hybrid Trading

- By combining multiple perspectives, investors can make more accurate investment decisions and minimize risks.

- Each analysis method has its own advantages. Combining them helps investors not miss any profitable opportunities.

- The market is always volatile, combining multiple methods helps investors flexibly adapt to market changes.

- For example, a combined investor can use fundamental analysis to find companies with good growth prospects. Then, they will use technical analysis to determine the right time to buy and sell.

Different Types of Analysis Styles In Hybrid Trading and Investing

Successful investors and traders often do not rely on just one method but combine different forms of analysis to make informed investment decisions. Here are some common forms of analysis:

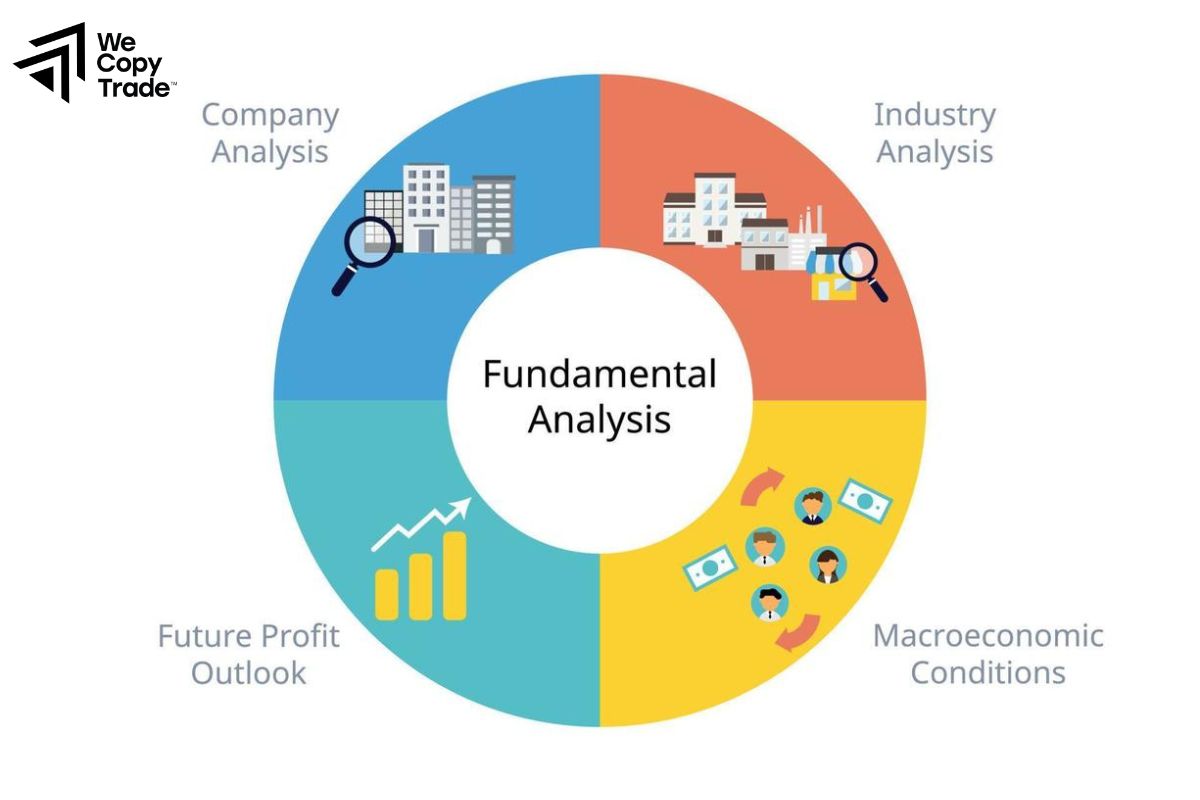

- Fundamental analysis: Similar to evaluating a company before investing, fundamental analysis focuses on examining the fundamental factors of a business such as:

- Financial situation: Revenue, profit, debt, etc.

- Business model: Products, services, target market, etc.

- Management: Board of directors, development strategy, etc.

- Industry: The company’s position in the industry, industry development trends, etc. By using fundamental analysis, investors can identify companies with the potential for sustainable growth in the long term.

- Technical Analysis: Looking at the past to predict the future, technical analysis focuses on studying price charts, trading volume, and other technical indicators to determine market trends, entry points, and exit points.

- Quantitative Analysis: Using mathematical and statistical models to analyze large amounts of market data. This method helps investors identify correlations between different factors, detect patterns, and make forecasts about price movements.

- Statistical Analysis: As a part of quantitative analysis, statistical analysis helps investors assess the probability of future events based on historical data.

For example: An investor might use fundamental analysis to identify technology companies with high prospects. They would then use technical analysis to determine when to buy when the stock price reaches a certain support level. Finally, they use quantitative analysis to determine what factors influence that company’s stock price and build a price forecasting model.

The Role of Data in Hybrid Trading

In the dynamic world of hybrid trading, data is the lifeblood. Investors and traders rely on a wealth of information to make informed decisions. From traditional sources like financial news and economic indicators to cutting-edge data analytics tools, they scour the market for valuable insights.

Effective data management and analysis are crucial to success. By leveraging advanced technologies, traders can identify patterns, trends, and anomalies that may not be apparent to the naked eye. This enables them to make timely and profitable trading decisions.

Hybrid Trading Strategy

To be successful in trading and investing together, you need:

- Not only a solid knowledge of companies, industries and economies, but also a good understanding of how the market works, the factors that affect prices and technical analysis tools.

- The ability to combine different analysis methods such as fundamental, technical, quantitative and statistical analysis to evaluate a stock or asset.

- Know how to identify and manage risks in each transaction, set clear stop loss and take profit points.

- Stick to the set trading plan, do not let emotions dominate your decisions.

- The financial market is always volatile, success does not come immediately. You need to persevere and learn from mistakes.

For example: An investor can use fundamental analysis to find a promising technology company. They will then use technical analysis to determine when to buy when the stock price reaches a certain support level. Finally, they use quantitative analysis to determine what factors influence that company’s stock price and build a price forecasting model.

Hybrid Trading vs. Other Styles of Trading

The financial market is extremely diverse and rich, and each investor has his or her own approach to conquering the market. To achieve success, it is extremely important to understand the different trading styles. Here are some popular trading styles:

Fundamental Analysis

- Long-term investors who look for companies with sustainable growth potential evaluate the intrinsic value of a company based on fundamental factors such as financial statements, business situation, industry, etc.

- For example: Investing in the stock of a company with stable profit growth and good industry prospects.

Technical Analysis

- Short-term traders who want to take advantage of short-term price fluctuations often analyze price charts, trading volume, and technical indicators to predict future market trends.

- For example: Buying a stock when the price breaks a strong resistance line.

Quantitative Trading

- Large hedge funds, algorithmic traders use mathematical models, algorithms and big data to find trading opportunities.

- For example: Creating algorithms that automatically trade based on technical signals and market data.

Statistical Arbitrage

- Hedge funds, professional traders look for anomalies in the prices of different assets and exploit them to make profits.

- For example: Buying a stock that is undervalued compared to another stock in the same industry.

Hybrid Trading

- For most investors and traders. They combine both fundamental and technical analysis to make trading decisions.

- For example: Investing in a stock that has good fundamentals and is forming a bullish pattern on the chart.

Conclusion

In conclusion, Hybrid Trading and investing together is an effective strategy for investors who want to diversify their portfolio and increase their profitability. However, the market always has many potential risks. To be successful with this strategy, investors must always update their knowledge of both fundamental and technical analysis.

See more: