Unlock the potential of currency correlations in your trading strategy! Knowing how currency pairs move together or against each other can help you manage risks, enhance profitability, and make smarter trading decisions. Whether you’re new to trading or a seasoned pro, understanding correlations between currencies is essential. Dive into our in-depth guide to master the art of currency correlations and start optimizing your portfolio today!

What Is Currency Correlations?

Currency correlations refer to the relationship between the movements of two currency pairs in the forex market. This relationship is measured by a correlation coefficient ranging from -1 to +1: a positive correlation (closer to +1) means the pairs tend to move in the same direction, while a negative correlation (closer to -1) indicates they usually move in opposite directions.

For example, EUR/USD and GBP/USD often have a positive correlation, as both involve the U.S. dollar as the quoted currency, while USD/JPY and EUR/USD generally show a negative correlation. Understanding these correlations helps traders manage risk, diversify their portfolios, and make more strategic decisions when selecting currency pairs.

See now:

- Choosing PAMM and MAM Accounts for Your Brokerage Platform

- Top VPS Hosting You Must Know for Your best Trading

- Guide How To Check And Choose FSCA Regulated Brokers

- What is the National Futures Association? NFA license broker

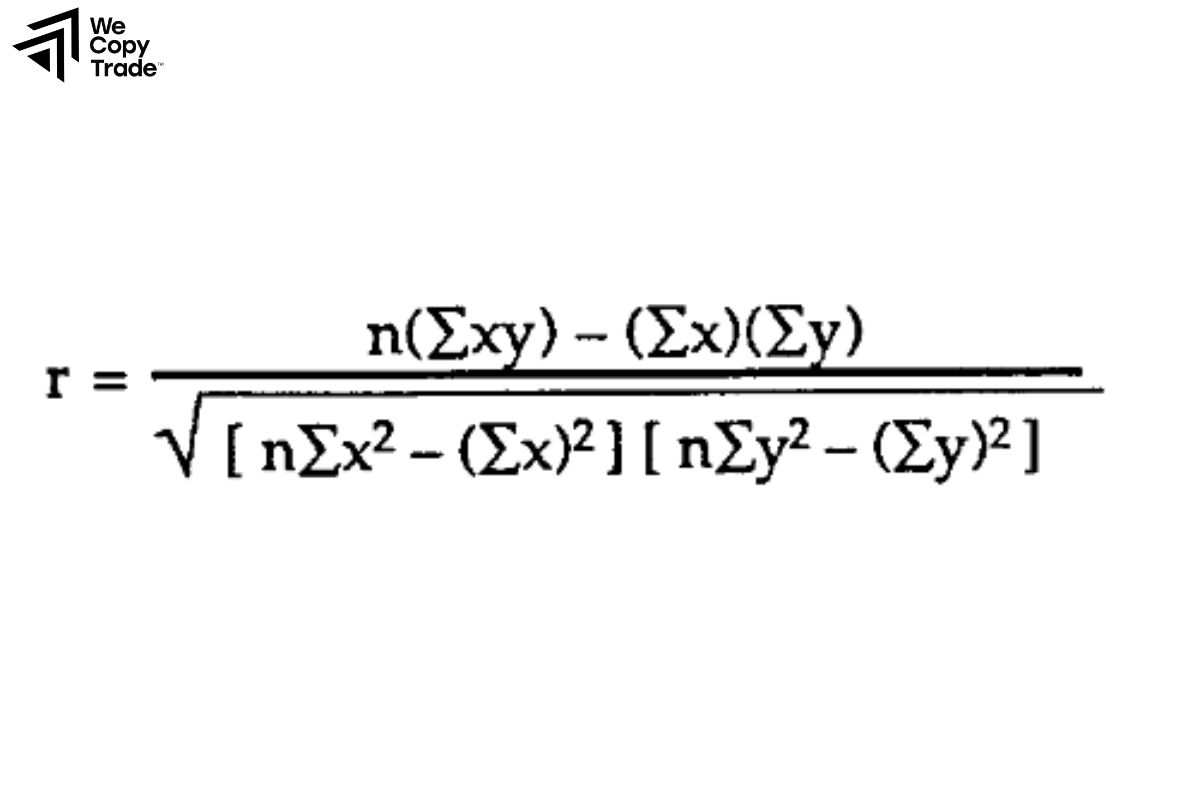

Currency correlation formula

The formula for calculating the correlation between two currency pairs is based on the Pearson Currency Correlations coefficient. This formula measures the linear relationship between two sets of returns and is represented as follows:

ρX,Y = ∑(Xi−X‾) x (Yi−Y‾) / ∑ (Xi−X‾)2 x ∑(Yi−Y‾)2

where:

- ρX,Y is the correlation coefficient between currency pair returns XXX and YYY,

- Xi and Yi are the individual return values of currency pairs XXX and YYY,

- X‾ and Y‾ are the mean returns of XXX and YYY,

- The formula sums up over all values in the data set.

Types of Currency Correlations

Currency correlations can generally be classified into three main types based on their correlation coefficient values:

Positive Correlation

- A positive correlation occurs when two currency pairs tend to move in the same direction. If one pair rises, the other likely rises as well, and if one falls, the other does too. This is often seen with currency pairs that have a common currency.

- For instance, EUR/USD and GBP/USD typically have a positive correlation because both pairs include the U.S. dollar as the quoted currency. Positive correlations can be strong (+0.8 to +1), moderate (+0.5 to +0.8), or weak (+0.1 to +0.5).

Negative Correlation

- A negative correlation occurs when two currency pairs tend to move in opposite directions. If one pair rises, the other is likely to fall. This is often the case with currency pairs where the U.S. dollar is the base currency in one pair and the quote currency in another.

- For example, USD/JPY and EUR/USD usually have a negative correlation, as movements in the U.S. dollar will often affect them inversely. Like positive correlations, negative correlations can also be strong (-1 to -0.8), moderate (-0.8 to -0.5), or weak (-0.5 to -0.1).

No Correlation

- When there is little or no relationship between the movements of two currency pairs, they are said to have no correlation. In this case, the correlation coefficient is close to zero, meaning the movements of one pair do not predict or affect the movements of the other.

- For example, USD/JPY and GBP/AUD may sometimes exhibit very low or no correlation since they involve different currencies that may not react similarly to economic events.

What are the most highly correlated currency pairs?

Highly correlated currency pairs often involve pairs with shared currencies, particularly when influenced by similar economic conditions or market movements. Here are some of the most common ones:

EUR/USD and GBP/USD

These two pairs often show a strong positive correlation. Both have the U.S. dollar as the currency, and the economies of the Eurozone and the UK tend to be closely related. When the USD strengthens or weakens, it often affects both pairs in similar ways.

EUR/USD and USD/CHF

These pairs typically have a strong negative correlation. The U.S. dollar serves as the quoted currency in EUR/USD and the base currency in USD/CHF, so movements in USD tend to impact them inversely. Switzerland’s economic ties to the Eurozone also play a role in their opposite movements.

AUD/USD and NZD/USD

These pairs often show a strong positive correlation due to the close economic ties between Australia and New Zealand. Both currencies also tend to be influenced similarly by global commodity prices and risk sentiment, moving together against the USD.

USD/JPY and USD/CHF

These pairs tend to have a positive correlation. Both involve the USD as the base currency and are regarded as safe-haven currencies, often moving similarly in response to global risk events.

EUR/JPY and EUR/USD

While not as highly correlated as the pairs above, EUR/JPY and EUR/USD can still show a moderate positive correlation due to the Euro. Movements in the Euro against the USD often similarly affect the Euro’s strength against the JPY.

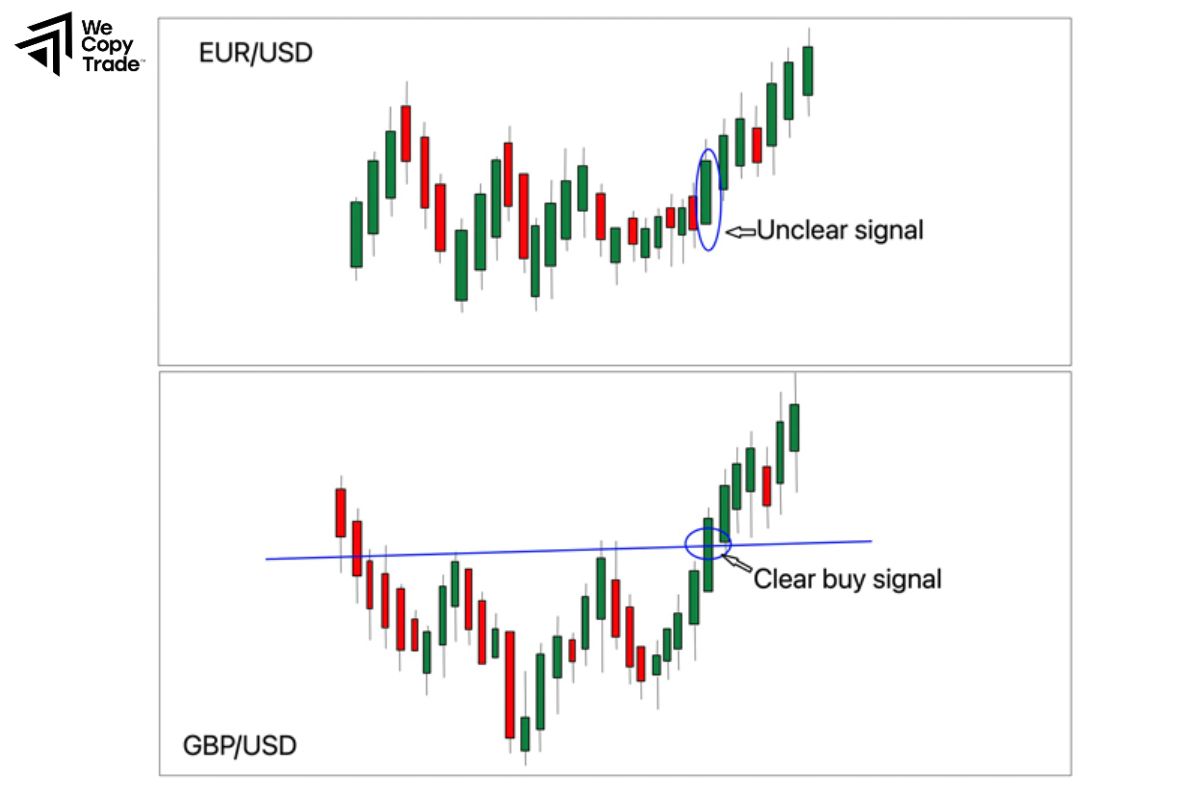

How to Use currency correlations to Trade Forex

Currency correlation is a helpful tool in Forex trading that helps you understand how currency pairs move in relation to each other. By understanding correlation, you can reduce risk and optimize your trading strategy.

Understand Currency Correlations

- Positive Correlation: When two currency pairs move in the same direction, like EUR/USD and GBP/USD.

- Negative Correlation: When they move in opposite directions, like EUR/USD and USD/CHF.

Using Correlation to Manage Risk

- Avoid opening multiple positions with strong correlations: For example, if you buy EUR/USD and GBP/USD, you are betting on the USD. If the USD weakens, both trades could lose.

- Try negative correlation pairs to offset risk: For instance, buy EUR/USD and sell USD/CHF to reduce potential losses.

Diversify Your Portfolio

- Trading pairs with low correlation helps spread risk because they have less impact on each other.

Monitor Correlation Regularly

- Correlation can change over time, so you need to check it frequently to adjust your strategy when needed.

Example of currency correlation

Here are some examples of Currency Correlations in Forex trading:

- Positive Correlation (Same Direction): If EUR/USD rises due to a weak USD, GBP/USD might also rise as the pound typically follows the euro’s movement.

- Negative Correlation (Opposite Direction: If EUR/USD goes up because of a weakening USD, USD/CHF may fall because a weaker USD makes the Swiss franc stronger in comparison.

- Weak or No Correlation: If EUR/USD moves up due to U.S. economic news, AUD/JPY might not necessarily follow the same trend.

- High Positive Correlation (Close to +1): If the price of gold rises, both AUD/USD and NZD/USD are likely to appreciate due to their correlation to commodity exports.

Conclusion

In conclusion, understanding currency correlations is a powerful tool for Forex traders looking to optimize their trading strategies. By recognizing how different currency pairs move in relation to each other, you can better manage risk, diversify your trades, and make more informed decisions. Stay ahead of the market and make smarter trading choices by utilizing this key concept. Join us now and elevate your trading game!

See more: