Do you know why stock prices fluctuate? Do you want to predict price fluctuations in your market? If so, you definitely cannot ignore the market news factor. Understanding the causes of fluctuations will help you make smart investment decisions and minimize risks. Follow the article below to understand more!

What is Market News?

Market news is the latest information about events, trends, and figures in the financial markets. From a company’s earnings report, to a central bank’s interest rate decision, to geopolitical developments, everything can impact the prices of assets like stocks, bonds, commodities, and more.

See more:

- Forex and Commodities – Which can we get more profits from?

- Forex and Stocks Trading What Should Traders Know?

- How to Use Currency Correlations to Trade Forex for beginner

Why do we need to update the market news?

In the ever-changing financial world, staying updated with market news is extremely important, especially for investors and traders. So why?

- Make informed decisions: Market news provides up-to-date information on the economy, businesses, and world events. Thanks to that, we can better understand the market and make appropriate investment decisions.

- Seize opportunities: Good news about a company can help us recognize potential investment opportunities. On the contrary, bad news can help us avoid unnecessary risks. Based on updated information, businesses can make the right business decisions.

- Predict trends: By closely following market news, we can predict market fluctuations and seize trading opportunities in time.

- Understand the market better to recognize new trends, analyze competitors, and assess potential risks.

For example:

- When a company reports better-than-expected earnings, its stock price often rises.

- An unexpected political event can cause sharp fluctuations in the stock market.

Common types of market news

Here are the types of market news that have the strongest impact on price fluctuations in the market that you need to pay attention to when investing:

Interest rate news

When the central bank decides to raise interest rates, investors will be less willing to borrow money to invest in stocks, causing stock prices to fall. Bond buyers will find newly issued bonds more attractive, so they sell old bonds, causing the price of old bonds to fall. Foreign exchange investors will transfer money to currencies with higher interest rates, reducing the value of the domestic currency. Businesses will have to pay more interest on loans, leading to reduced profits and possibly cutting production. On the contrary, when interest rates fall, things will go in the opposite direction.

Economic news

Like a company, each country also has an annual “financial report”. These reports show whether the country’s economy is healthy or weak. If a country has a strong economy, their currency will usually be worth more.

For example, news about positive employment data in a developing country means that the country’s economy is strong, investors will invest more, causing the value of that country’s currency to increase.

Commodity News

A country’s currency can be significantly influenced by the price of commodities it exports, particularly oil. When a nation is a major oil exporter, fluctuations in global oil prices can directly impact its economy and currency.

Political News

Political events such as elections, wars, or changes in policy can cause large movements in the forex market. These events can lead to increased market volatility and significant price movements in currency pairs. And it’s important to remember that political events can be unpredictable, and it’s crucial to have a solid risk management plan in place.

Where and How can I find Reliable Market News Sources?

To understand the market, you should refer to many different sources of information such as:

- Financial news channels: Bloomberg, CNBC, Reuters provide in-depth and updated analysis.

- Social networks and forums: These platforms provide diverse perspectives and useful information.

How to Stay Up to Date with Accurate Market Information

Not all information online is reliable. You need to:

- Find reputable sources with a history of accurate reporting.

- Compare and check information from multiple sources to ensure accuracy.

- Sign up for newsletters, follow industry websites.

- Connect with industry insiders to exchange information.

What is Market News Trading?

Market news trading is an investment strategy where traders take advantage of important market news events to predict the price movements of assets such as stocks, currencies or commodities.

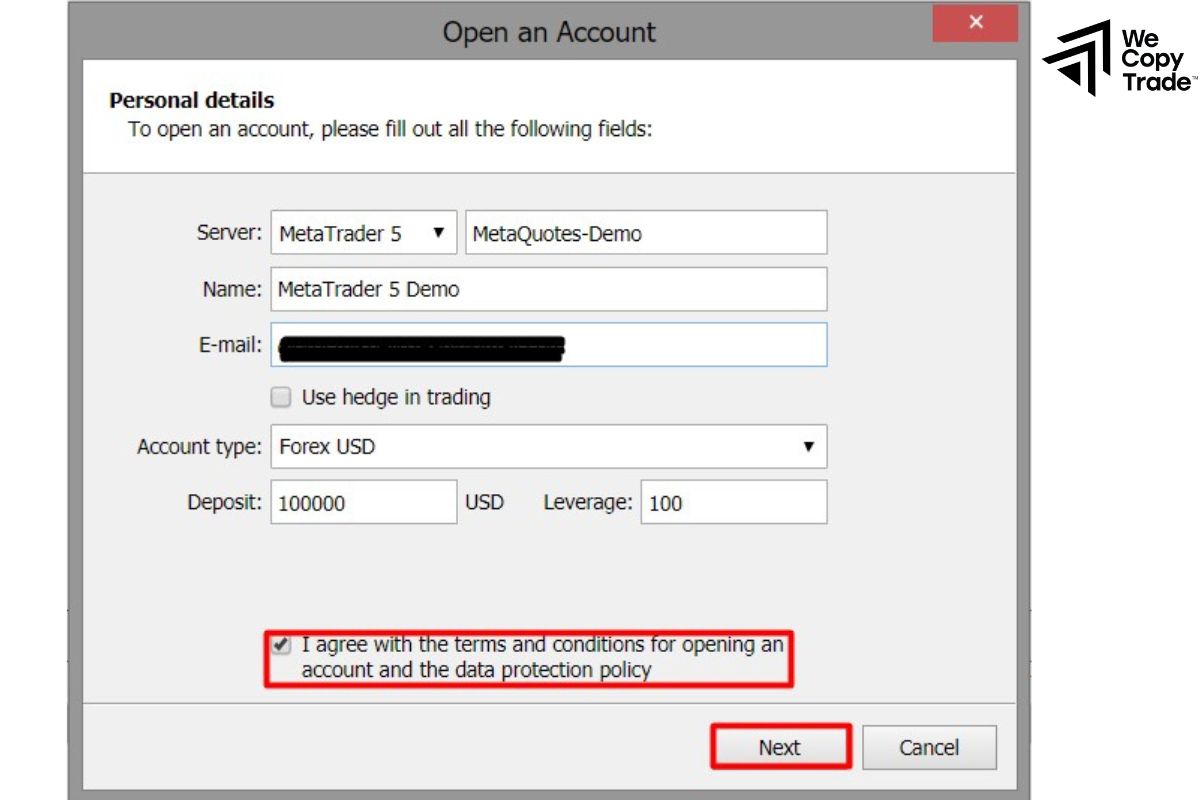

Step 1: Open a Trading Account

- There are many trading platforms on the market, each with its own advantages and disadvantages. Do your research and choose a reputable trading platform that suits your needs.

- Before trading with real money, use a demo account to get familiar with the interface, trading tools and practice your strategies.

Step 2: Stay up to date with market news

- Regularly read articles, analysis reports from experts and reputable financial news sites.

- Learn about economic indicators such as GDP, inflation, unemployment rates… because they have a big impact on the market.

- Follow important events such as central bank press conferences, corporate earnings reports… because they can cause strong fluctuations in the market.

Step 3: Build a trading strategy

Learn about economic and political factors that affect prices, combined with using charts and technical indicators to identify trends and entry points. There are many different trading strategies, you should choose the strategy that suits your investment style and goals, you can:

- Place buy/sell orders before the news is released to take advantage of immediate price movements.

- Always place stop-loss orders to limit losses if your prediction is wrong.

- Adhere strictly to your trading plan.

For example:

Let’s say you get information that a technology company has just signed a big contract. You can predict that the company’s stock price will increase and place a buy order before the news is widely released.

Step 4: Risk management

Set stop-loss orders to limit losses when the market goes against your prediction. And don’t just invest in one type of asset, allocate capital to many different assets to minimize risk.

Conclusion

In conclusion, keeping up to date with market news plays an important role in helping us make effective business decisions. However, to make the most of this information, we need to know how to analyze and evaluate the information objectively.

See now: