Emotions in trading play a crucial role in your decision-making and overall success. Whether it’s fear holding you back, greed driving risky moves, or stress clouding your judgment, understanding and managing your emotions is essential. Discover proven techniques to keep a clear mind, build confidence, and maintain discipline in every trade. Don’t let emotions dictate your outcomes, take control of your trading journey today! Click here to unlock strategies for mastering your mindset and achieving consistent results.

What are emotions in trading?

Emotions in trading refer to the psychological states and feelings that influence a trader’s decisions and actions in the financial markets. These emotions arise from the inherent risks, uncertainties, and pressures associated with trading. They can impact judgment, often leading to impulsive or irrational behavior that deviates from well-planned strategies.

When emotions dominate, traders may struggle to make objective decisions, overlook critical information, or react unpredictably to market fluctuations. Understanding and managing these emotions is essential for maintaining discipline, staying focused, and achieving long-term success in trading.

See now:

- What Does Patience in Market Entry Mean? Importance in forex

- Why Shouldn’t We Overtrade? How To Avoid Overtrading

- What is a Trading Journal? Components of a Trading Today

- Contrarian Trading – 5 Valuable Lessons of Famous Contrarian

Why Controlling Emotions Matters in Trading?

Controlling emotions in trading is crucial because emotions can significantly influence decision-making, often leading to mistakes that impact profitability. The financial markets are volatile and unpredictable, creating situations where fear, greed, or frustration may override rational thinking. Traders who fail to manage their emotions are more likely to abandon strategies, take unnecessary risks, or make impulsive decisions based on temporary feelings rather than logical analysis.

Maintaining emotional control allows traders to stick to their plans, evaluate situations objectively, and execute trades based on data and strategy rather than reaction. It also helps to minimize the psychological stress associated with losses or market downturns, enabling a more consistent and disciplined approach. In essence, mastering emotions is essential for long-term trading success and for building resilience in the face of market challenges.

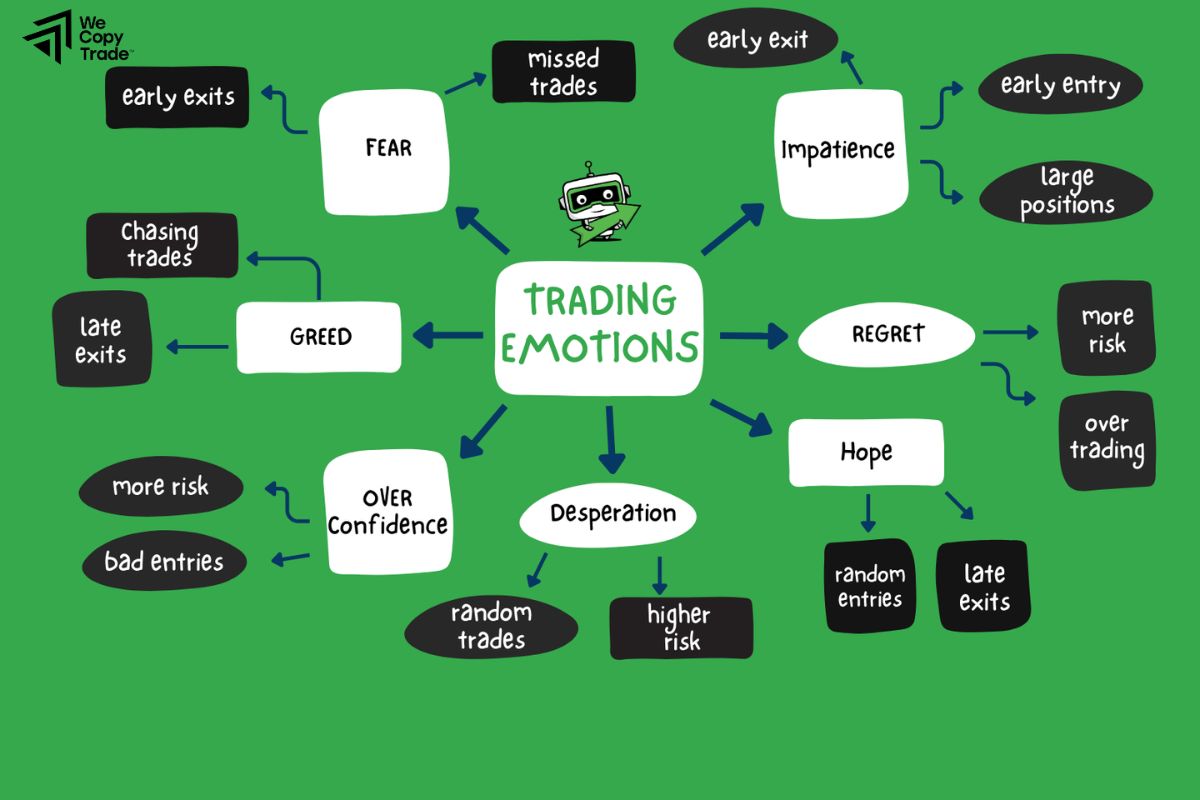

Common Emotions in Trading Experience

Trading can be an emotionally intense experience, with emotions often fluctuating based on market movements, personal decisions, and financial outcomes. Here are some of the common emotions traders experience:

Excitement

- Often felt when a trade goes as planned, or when entering a market that appears to present high-profit opportunities.

- Can lead to overconfidence if not tempered.

Fear

- Triggered by market volatility, fear of losses, or missing out on profitable opportunities.

- Can cause hesitation or impulsive decisions.

Greed

- An intense desire for profit, often leading traders to hold onto winning trades for too long or take excessive risks.

- Can result in missed profits or unexpected losses.

Anxiety

- Common during uncertain market conditions or when holding a position that fluctuates wildly.

- May impair clear thinking and lead to overtrading or early exits.

Frustration

- Arises from repeated losses, missed opportunities, or poorly executed trades.

- Can lead to revenge trading, where traders make rash decisions to recover losses.

Euphoria

- Felt after significant wins or a series of successful trades.

- May result in overconfidence, leading to increased risk-taking.

Regret

- Occurs when traders make mistakes, such as exiting a trade too early or missing a profitable opportunity.

- Can weigh on future decision-making.

Confidence

- Grows with experience and consistent profits.

- Balanced confidence is key to maintaining discipline and making rational decisions.

How to Control Emotions in Trading?

Controlling emotions in trading is crucial for making rational decisions and avoiding impulsive actions that can lead to losses. Here are several strategies to help manage emotions effectively. 5 Ways to Control Emotions in Trading:

Method 1: Develop a Trading Plan

- Create a detailed trading plan with clear rules for entry, exit, and risk management.

- This helps you stick to principles and avoid impulsive decisions influenced by emotions.

Method 2: Manage Risk and Use Stop-Loss Orders

- Use stop-loss orders to limit potential losses and protect your account.

- Proper risk management minimizes the emotional impact of market fluctuations and prevents panic or rash actions.

Method 3: Stay Calm and Focused

- Practice techniques like deep breathing, meditation, or taking breaks when feeling stressed.

- Staying calm helps you make rational decisions and prevents emotions like greed or fear from affecting your trades.

Method 4: Keep a Trading Journal

- Record all your trades and emotions during each one.

- This helps you identify emotional patterns and learn from mistakes, improving your trading skills over time.

Method 5: Accept Losses and Learn from Them

- Losses are inevitable in trading.

- Accepting them as part of the learning process helps you avoid letting regret or frustration impact your decisions in future trades.

Strategies to Manage Emotions in Trading

- Create a Trading Plan: Define entry, exit, and risk management rules. A clear plan helps reduce emotional decisions and maintain discipline.

- Use Risk Management Tools: Apply stop-loss orders and proper position sizing to limit losses and avoid emotional reactions like fear or greed.

- Practice Emotional Detachment: Treat trading objectively. Avoid over-trading and focus on the process, not individual results.

- Establish a Routine and Take Breaks: Follow a consistent routine and take regular breaks to prevent burnout and stay clear-headed.

- Track Your Trades and Emotions: Keep a journal of trades and emotions to identify patterns and learn from experiences.

- Focus on the Long-Term: Focus on overall performance rather than short-term wins or losses to reduce emotional highs and lows.

FAQ about Emotions in Trading

Why do emotions affect my trading?

- Emotions such as fear, greed, and excitement can cloud judgment, leading to impulsive decisions. These emotions often result in chasing losses, overtrading, or taking unnecessary risks.

Can mindfulness help with emotions in trading?

- Yes, mindfulness techniques such as deep breathing or meditation can help you stay calm and focused, reducing emotional reactions and promoting clearer decision-making.

Should I trade when I’m emotional?

- No, it’s best to avoid trading when you’re feeling overly emotional (angry, anxious, or overly excited). Emotions can lead to poor decision-making and mistakes. Take a break and return when you’re in a calmer state of mind.

Conclusion

In conclusion, emotions in trading can significantly impact your decisions, often leading to impulsive actions like chasing losses or taking unnecessary risks. Understanding the role of emotions, such as fear, greed, and excitement, is key to becoming a more disciplined and successful trader. If you’re ready to take control of your emotions and enhance your trading skills, start by implementing these techniques today. Stay disciplined, stick to your plan, and keep learning to improve your trading journey.

See more: