Day Trading can be a powerful way to make profits in the stock market, but success requires the right knowledge and strategies. In this guide, you’ll learn the fundamentals of Trading, from choosing the best stocks to managing risks effectively. Whether you’re a beginner or an experienced trader, get the tips and tools you need to succeed. Ready to dive in and start making smarter trades? Keep reading to master the world!

What is Day Trading?

Day trading is a short-term investment strategy where traders buy and sell financial instruments like stocks, cryptocurrencies, or commodities within a single trading day. The goal is to capitalize on small price movements, taking advantage of market fluctuations over a short period.

Unlike long-term investing, which involves holding assets for months or years, day traders close all their positions before the market closes, avoiding overnight risks and exposure to unexpected events. Successful day trading relies heavily on market analysis, quick decision-making, and effective use of trading tools.

See now:

- Compare the best bank transfers brokers you should know

- What are the Benefits of Using Expert Analysis Forex?

- What are trading signals? How to use trading effectively?

Characteristics of Day Trading method

Day trading has several distinct characteristics that set it apart from other trading methods. Here are the key characteristics of the approach:

- Buy and Sell Within the Same Day: Day traders open and close positions within a single trading day. No trades are held overnight, reducing exposure to unexpected market news or events that can impact prices when the market is closed.

- Multiple Trades Daily: Day traders execute a high number of trades daily to take advantage of small price movements. The goal is to make profits on multiple small trades, rather than relying on a single large price swing.

- Highly Liquid Markets: Day traders prefer assets with high liquidity, such as major stocks, popular cryptocurrencies, or forex pairs. High liquidity allows for quick entry and exit with minimal slippage (price changes between placing an order and its execution).

- Borrowed Capital: Many day traders use leverage to increase their buying power. This can amplify profits, but it also increases the risk of significant losses, making risk management crucial.

- Charts and Indicators: Day traders rely heavily on technical analysis, using price charts, candlestick patterns, and indicators like Moving Averages, Relative Strength Index (RSI), and Bollinger Bands to predict short-term price movements.

- Minimal Fundamental Analysis: There is less focus on the underlying value of an asset and more on price action and market trends.

- Fast Execution: Day trading requires making rapid decisions, as opportunities can appear and disappear in seconds. Traders need to stay alert to market changes and act swiftly to capitalize on them.

How to use Day Trading strategy?

Here’s a concise guide on how to use a Day Trading strategy in 6 steps:

Step 1: Preparation and Research

- Learn about the market, different asset types, and technical analysis tools.

- Choose the right market (stocks, forex, crypto) and create a trading plan with a specific strategy.

Step 2: Use Technical Analysis

- Use technical analysis tools to identify trends and entry/exit points.

- Utilize indicators like RSI, MACD, and Bollinger Bands to predict short-term price movements.

Step 3: Choose a Day Trading Strategy

- Select a specific strategy that suits your trading style, such as Scalping, Breakout, Momentum, or Reversal.

Step 4: Set Up and Manage Risk

- Place Stop-Loss and Take-Profit orders to control risk.

- Determine position size based on your risk tolerance.

Step 5: Monitor the Market and Execute Trades

- Keep an eye on price charts, market news, and economic events that may impact prices.

- Execute trades according to your plan, avoiding emotional decisions.

Step 6: Review and Adjust

- Review your completed trades, note results, and learn from experiences.

- Adjust your strategy and plan if needed to optimize trading performance.

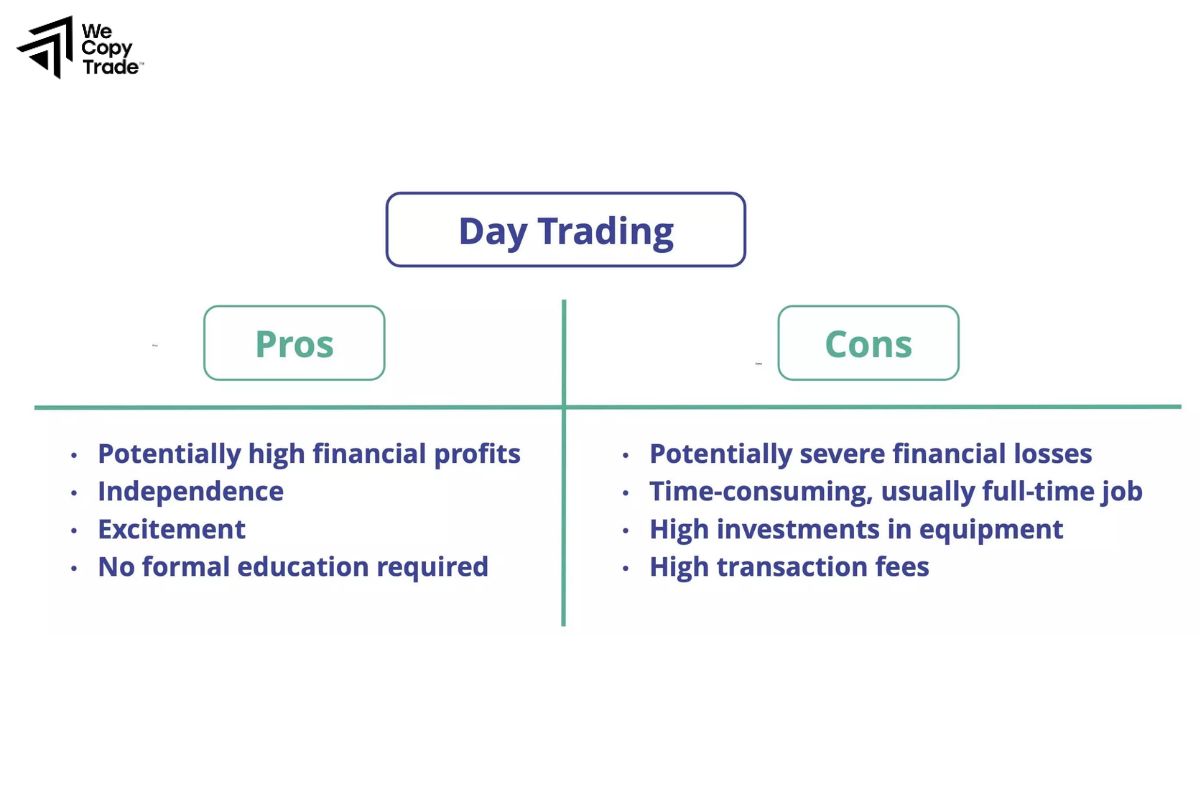

Advantages and disadvantages of Day Trading strategy

Here are the advantages and disadvantages of using a Day Trading strategy:

Advantages of Day Trading

- Day trading allows traders to capitalize on short-term price movements, potentially making quick profits within a single day without holding positions overnight.

- Since positions are closed before the market closes, day traders avoid risks related to unexpected news or events that can occur after trading hours, reducing exposure to overnight market gaps.

- Day trading offers flexibility to choose when to trade, allowing traders to focus on peak market hours or specific trading sessions that suit their schedule.

- Many brokers offer leverage for day trading, allowing traders to increase their buying power and potentially amplify profits.

Disadvantages of Day Trading

- The fast-paced nature of day trading can lead to significant losses if trades go wrong. It’s a high-risk strategy that requires skill, discipline, and quick decision-making.

- It can be mentally and emotionally taxing, as traders must make rapid decisions while facing market volatility. This pressure can lead to impulsive or emotional trading.

- Frequent buying and selling can result in high transaction costs, including commissions and fees, which can eat into profits, especially for traders with lower capital.

- Day trading requires constant monitoring of the market throughout the trading session. It can be time-consuming and requires a significant commitment to stay updated with price movements.

Who is suitable for Day Trading strategy?

Day trading is not for everyone, as it requires a specific set of skills, temperament, and resources. Here are the types of individuals who may be well-suited strategy:

Individuals with a High Risk Tolerance

- Day trading involves significant risks due to market volatility and the potential for rapid gains or losses. Those who are comfortable with taking on risk and can manage the emotional highs and lows may be more suited.

People Who Can Commit Time

- Day trading demands constant attention to the market during trading hours. It is suitable for individuals who can dedicate several hours a day to actively monitor market movements, charts, and news.

Traders with Strong Analytical Skills

- Successful day traders need a good grasp of technical analysis, chart patterns, and indicators. Those who enjoy researching and analyzing market data, trends, and price movements may excel.

Discipline-Oriented Individuals

- Discipline is crucial in day trading to follow a set strategy, manage risks, and avoid impulsive decisions. Traders who are able to stick to their plan without deviating based on emotions are better suited for this style.

Those with Access to Adequate Capital

- Day trading typically requires sufficient capital to withstand market fluctuations and meet margin requirements. Traders who can afford to invest a reasonable amount without risking financial hardship may find more viable.

People Who Thrive in Fast-Paced Environments

- Day trading involves making quick decisions under pressure. Individuals who are comfortable in fast-paced, dynamic situations and can think on their feet are likely to find it appealing and manageable.

Notes when using Day Trading strategy

Here are some essential notes to keep in mind when using a Day Trading strategy:

- Have a Clear Plan and Strategy: Enter each trading session with a well-defined strategy, including entry and exit points, stop-loss levels, and profit targets. Avoid making impulsive decisions; stick to the plan.

- Manage Risk Carefully: Use risk management tools like Stop-Loss orders to limit potential losses and Take-Profit orders to secure profits. Only risk a small percentage of your trading capital per trade, typically no more than 1-2% to protect your portfolio.

- Stay Informed: Keep up with market news, economic data, and major events that can impact the assets you’re trading. Be aware of market opening and closing times, and avoid trading during periods of high volatility unless it’s part of your strategy.

- Avoid Overtrading: Don’t feel compelled to trade constantly. Only trade when your setup criteria are met. Overtrading can lead to emotional and impulsive decisions, which often result in losses.

- Keep Emotions in Check: Day trading can be stressful due to rapid market changes. Learn to control emotions like fear and greed, which can cloud judgment. Stick to logic and analysis rather than reacting emotionally to market movements.

Conclusion

In conclusion, day trading offers exciting opportunities to profit from short-term market movements, but it requires careful planning, discipline, and a strong understanding of market analysis. By following a solid strategy, managing risks effectively, and staying emotionally disciplined, you can improve your chances of success. If you’re ready to take your trading skills to the next level, start by practicing with a demo account and learning from your trades.

See more: