In recent years, prop firm investment trends have been booming, opening up new opportunities for individual traders worldwide. No longer solely the domain of large financial institutions, prop firms have undergone significant transformation thanks to technology and more flexible funding models. So, what’s shaping the future of this market? What should traders prepare for to catch the next wave of prop firm investment trends? Read on to find out more.

Popular Funding Models in Prop Firm Investment Trends

As prop firm investment trends continue to spread, funding companies are constantly innovating their capital provision models to better suit the needs of modern traders. Instead of a single fixed format, traders now have a variety of funding models to choose from – ranging from traditional to instant funding – with increasing levels of flexibility.

See more:

- Prop Firm Success Factors That Every Trader Must Know

- How to Build an Effective Prop Firm Strategy for Traders

- Top Prop Firm Investment Factors That Traders Need To Pay Attention To

- 7 Essential Prop Firm Soft Skills Traders Need to Succeed

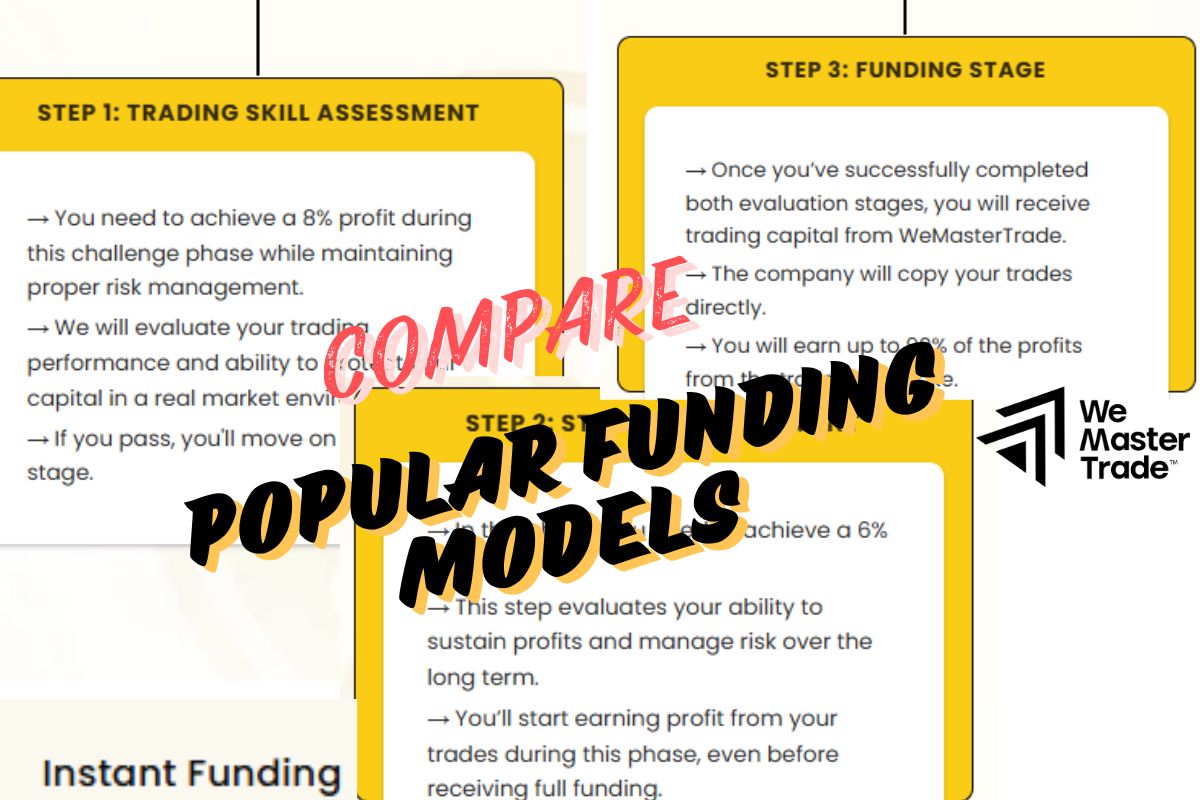

Comparing Current Popular Funding Models

- One-Phase Challenge: Traders only need to pass a single evaluation round. This model saves time but often comes with stricter requirements for profit targets or trading time limits

- Two-Phase Challenge: This is the most common model within current prop firm investment trends. Traders must pass two challenge rounds, demonstrating stability and risk control abilities. It offers a balance between difficulty and accessibility.

- Three-Phase Challenge: This is typically for traders who prioritize lower costs or want to increase their chances of passing the challenge. However, it requires more time and patience.

- Instant Funding: Traders receive capital immediately upon purchasing an account, without needing to pass a challenge. While quick and convenient, it comes with higher fees and stringent risk management requirements, often with limitations on profit withdrawals.

The diversity of funding models clearly shows that prop firm investment trends are shifting: from strict selection to a more user-friendly approach.

The Nature of Current Prop Firm Investment Trends

Along with the strong growth of the individual financial market, prop firm investment trends are gaining increasing attention. Here are the prominent factors driving this model to become an attractive choice for global traders:

Easier Access to Capital

Instead of requiring traders to commit large amounts of personal capital to start, modern prop firms offer a variety of flexible funding models – from Instant Funding to one, two, or three-phase challenges. Each model caters to different skill levels, allowing traders easy access to significant capital while minimizing personal financial risk. This is a crucial reason driving the widespread adoption of prop firm investment trends.

Application of AI and Technology in Risk Management

Today’s prop firms are actively integrating advanced technologies such as artificial intelligence (AI), algorithmic trading, and real-time risk management systems. These tools help traders:

- Analyze data rapidly

- Automatically set intelligent stop-loss orders

- Effectively control drawdown

- Increase trading discipline

Technology is creating a clear transformation in trading efficiency – a major driving force for professional prop firm investment trends.

Diversification of Tradable Assets

No longer limited to the Forex market, many prop firms have expanded their portfolios to include other asset classes such as:

- Cryptocurrencies (crypto)

- Commodities

- Futures

This diversification helps traders easily build flexible investment strategies and better adapt to market fluctuations – a trend highly sought after by many traders.

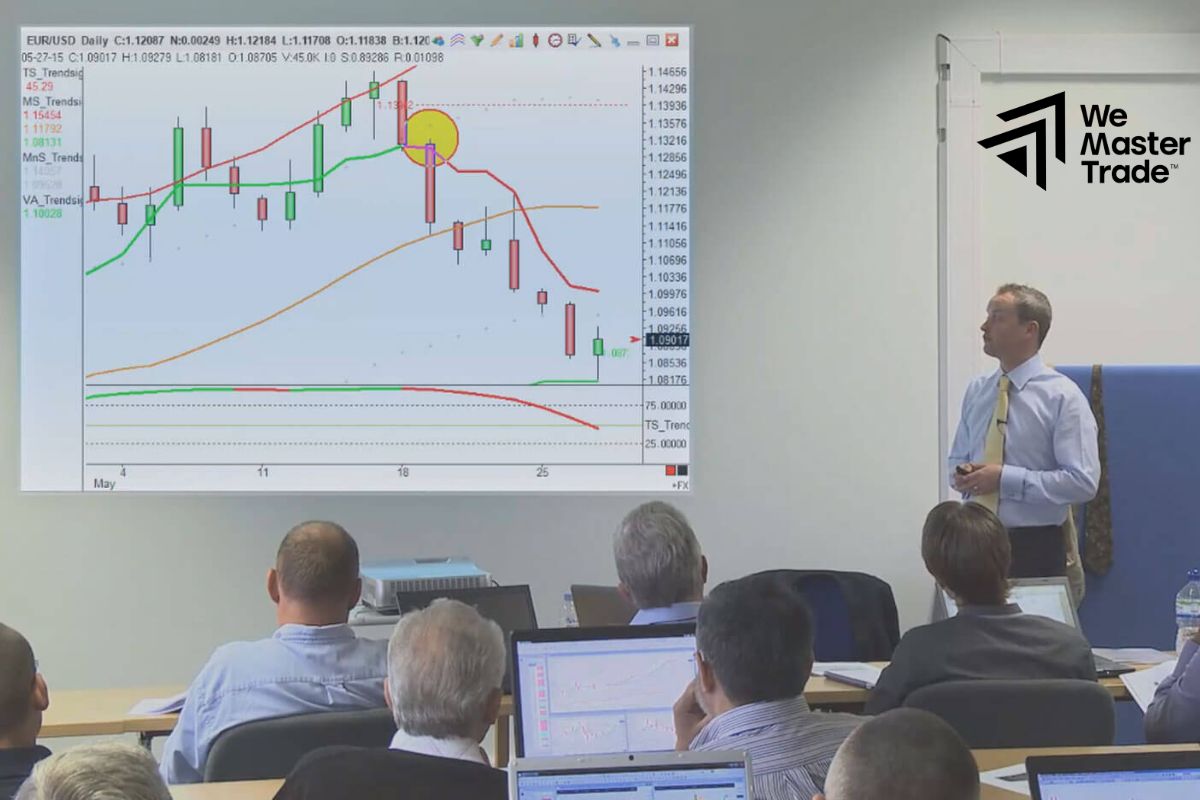

Enhanced Trader Training and Skill Development

To retain and nurture promising traders, many prop firms have focused on:

- Providing in-depth courses and coaching

- Fostering supportive communities

- Improving long-term trading skills

This investment not only helps traders increase their performance but also enhances the prop firm’s reputation within the community – contributing to the shaping of sustainable prop firm investment trends.

Increasing Transparency and Regulatory Clarity

As the prop trading market expands rapidly, regulatory bodies are also beginning to focus on establishing clearer legal frameworks, including:

- Regulations on funding sources

- Requirements for transparency regarding profit-sharing terms

- Mechanisms to protect traders from non-transparent risks

This increased transparency not only helps prop firms become more professional but also builds trust – a core element in modern prop firm investment trends.

What Individual Traders Should Note Regarding Prop Firm Investment Trends?

While prop firm investment trends are strongly developing and opening up many new opportunities, individual traders still need to be discerning when making choices. Not every prop firm is transparent or reliable. Here are some key considerations you should thoroughly review:

Clear Legal Verification

Verify the prop firm’s legal information, headquarters address, and operating licenses. Avoid platforms that are ambiguous about their origin, lack transparent contact information, or show signs of fraudulent activity.

Thoroughly Read Profit-Sharing and Withdrawal Policies

Some prop firms may offer high-profit share percentages to attract traders, but come with extremely difficult withdrawal conditions. Read all terms and conditions carefully before participating, especially concerning:

- Minimum holding time for trades

- Conditions for profit withdrawal

- Hidden fees (if any)

Avoid Believing Overly Good Advertisements

Claims like “easy pass,” “fast withdrawals in 24 hours,” or “100% pass rate” can be dishonest marketing tactics. Seek real evidence, community reviews, and especially, verify their refund policy if you don’t meet the requirements.

Conclusion

In summary, with the advancement of technology, business models, and training, prop firm investment trends are reshaping how individual traders enter the global financial market. However, don’t rush. For your investment journey to develop sustainably, take the time to thoroughly research before making a decision.

See more: