Are you looking for a reputable STP broker to develop creative and bold strategies for your investment journey? STP brokers is the top recommendation for you. With outstanding features, I believe that STP brokers will help you achieve success more easily. Follow me to find out how to choose the most suitable companion in the following article!

What is an STP Broker?

STP (Straight-Through Processing) or DMA (Direct Market Access) brokers are the direct bridge between the trader and the interbank forex market. This means that when you trade with an STP broker, your order will be routed directly to the major banks – the main liquidity providers for the market.

Advantages of STP brokers

STP brokers connect you directly to the forex market, without going through any other intermediary. This ensures:

- You will enjoy the best prices, closest to the actual market price.

- Thanks to modern technology, your trading orders are processed almost instantly, minimizing the risk of slippage.

- STP brokers do not profit from your losses, but from trading fees. Therefore, they always try to provide the best service so that you can make a profit.

- Many STP brokers allow you to trade with small lots, suitable for both beginners and traders with moderate capital.

See now:

- What is interest rate risk? How to manage interest rates

- Some Steps to Successful Liquidity Risk Management 2024

- Foreign Exchange Risk Mitigation Effectively In 5 Minutes

What is an STP Platform?

STP is a process that completely automated transactions, from start to finish, without human intervention. Simply put, STP makes transactions happen quickly, accurately and seamlessly. STP is widely used in securities, banking, insurance transactions to process purchases, payments, transfers, etc. to automate the ordering, payment and delivery process, providing a smooth online shopping experience for customers.

Choosing between an STP and ECN account depends on a number of factors, including:

- Trading experience: If you are a beginner, an STP account may be a better choice.

- Amount of investment: If you have a large capital, an ECN account can help you save on trading costs.

- Trading style: If you are an active trader and place orders frequently, an ECN account may be more suitable.

Top 10 STP Brokers Ranked

Here are the top 10 brokers that are recognized and trusted by major investors. From there, you can choose the broker that best suits your needs and trading style:

| Brokers | Minimum deposit | Spread | commission | maximum leverage | platform | pros |

| BlackBull Markets | from 0.8 pips | 6$/ lot (optional) | 1:500 | MT4, MT5, TradingView | No conflicts of interest, multiple account options | |

| Admiral Markets | 25$ | from 0.5 pips | No | MT4, MT5 | Suitable for beginners, many accounts to choose | |

| Vantage Markets | 50$ | from 1 pip | No | MT4, MT5, dedicated apps | Friendly interface, many trading assets | |

| HF Markets | No | from 0.0 pips | 3$/lot | 1:2000 | Ultra low spreads, no minimum deposit required | |

| Swissquote | 1.000$ | from 1.1 pips | No | Closely managed, reputable | ||

| FxPro | 0.05 pips (average) | 3.5$/lot | MT4 | STP technology, Competitive spreads | ||

| OctaFX | STP/ECN | From 0.6 | 0 | 1:500 | Competitive spreads, no commissions, low minimum deposit | |

| ActivTrades | STP | From 0.5 | 0 | MT4, MT5, TradingView | No requotes, multiple platforms | |

| Global Markets Group | STP | From 0.0 (EUR/USD) | 3.5$/lot | MT5 | Ultra-low spreads, multiple liquidity providers | |

| Forex4You | STP | from 0.1 | 8$/lot | 1:1000 | MT4, MT5 | Level 2 Data, High Leverage |

Comparison of STP and ECN Brokers

When choosing a Forex trading account, you will often encounter two main types: STP (Straight Through Processing) and ECN (Electronic Communication Network). So what is the difference between these two types of accounts and which one is right for you?

STP (Straight Through Processing) Account

When you place a trade order on an STP account, your order will be transmitted to a liquidity provider (such as a large bank) and executed immediately (usually through popular platforms such as MetaTrader 4, MetaTrader 5).

Advantages:

- Your trade order is executed almost immediately.

- Usually comes from one or a few liquidity providers that the broker cooperates with, with quite attractive spreads.

- Easy to use and suitable for both beginners and experienced traders.

Disadvantages:

- In some cases, the broker may intervene in the order execution process, especially in volatile market conditions.

- Market depth may be limited, especially in volatile market conditions.

ECN (Electronic Communication Network) Account

An ECN account is like an online stock exchange where traders, banks and other financial institutions meet to trade. Your trading orders will be placed directly into an “order book” and will be matched with other buyers or sellers’ orders automatically through dedicated platforms or advanced versions of MetaTrader.

Advantages:

- You can see the market depth and pending orders.

- Orders are filled instantly at the best available price.

- The broker cannot interfere with the order matching process.

- Connected to a large network of liquidity providers, including banks, financial institutions and other traders with competitive prices.

- Higher and more stable liquidity due to being provided by many different sources.

Disadvantages:

- In addition to the spread, you often have to pay a commission fee for each transaction.

- ECN accounts require you to have good knowledge of the market and technical analysis tools.

Tips for selecting the best STP broker

Here are some tips to help you choose the most suitable STP broker:

Compliance with regulations

When choosing a broker, you should look for transparency, fraud prevention and ensure that they protect the interests of investors through the websites of regulatory agencies to ensure accurate information.

In Europe, there is FCA (Financial Conduct Authority), in Australia, there is ASIC (Australian Securities and Investments Commission), …

Account features

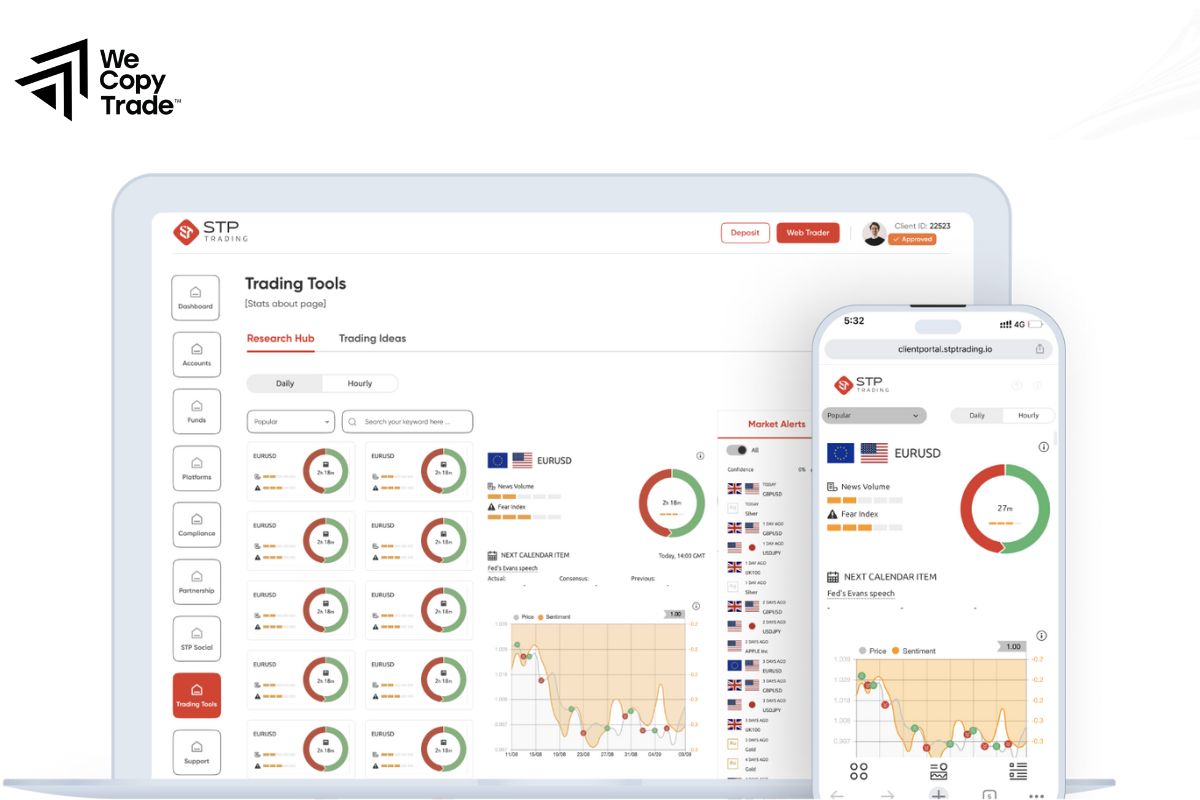

You should consider a number of factors such as MetaTrader 4, MetaTrader 5 platforms, each broker’s proprietary platforms, see if technical analysis support tools such as charts, indicators, market news and types of trading assets are suitable for your needs and trading style. At the same time, we should also consider the quality of customer support, response time, support channels (phone, email, online chat).

Currency pairs offered

High liquidity means that the currency pair is traded frequently, making it easier to enter and exit orders. Choosing brokers that offer a variety of currencies in addition to the major pairs, such as some cross pairs, exotic pairs such as USD/ZAR, EUR/JPY, etc. helps diversify your investment portfolio and limit risks.

Customer service

You should prioritize choosing brokers that support customers 24/7, ready to answer any questions via phone, email, online chat, and support ticket system to prevent system interruptions that cause loss of investment opportunities or even risk to assets.

Trading platform

A good trading platform will help you execute orders quickly, accurately, and limit slippage. You should prioritize choosing platforms with intuitive, easy-to-use interfaces, diverse drawing tools, technical indicators, advanced order placement features (stop loss orders, take profit orders, pending orders), integrated market news, economic calendars and compatibility with many devices (desktop, tablet, mobile phone).

Conclusion

In conclusion, STP brokers are the right choice for professional traders who understand the forex market and trading instruments. In my opinion, the perfect broker is not the best but the broker that best suits your needs. Please consult carefully before making a decision.

See more: